The smart Trick of Bankruptcy Lawyer Tulsa That Nobody is Discussing

The smart Trick of Bankruptcy Lawyer Tulsa That Nobody is Discussing

Blog Article

Not known Factual Statements About Tulsa Ok Bankruptcy Attorney

Table of ContentsHow Experienced Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.The smart Trick of Tulsa Ok Bankruptcy Attorney That Nobody is Talking AboutTulsa Bankruptcy Consultation Fundamentals Explained10 Easy Facts About Tulsa Bankruptcy Attorney Shown4 Easy Facts About Bankruptcy Attorney Tulsa Described

The statistics for the various other primary type, Chapter 13, are also worse for pro se filers. (We damage down the differences in between the two enters deepness listed below.) Suffice it to say, talk to a lawyer or more near you who's experienced with bankruptcy regulation. Below are a few sources to find them: It's understandable that you may be reluctant to spend for an attorney when you're already under significant economic pressure.Lots of lawyers additionally supply complimentary examinations or email Q&A s. Make use of that. (The charitable app Upsolve can assist you discover totally free examinations, resources and legal aid for free.) Ask them if bankruptcy is without a doubt the right choice for your circumstance and whether they think you'll certify. Before you pay to submit bankruptcy kinds and blemish your credit report for up to one decade, check to see if you have any type of sensible choices like financial obligation negotiation or charitable credit score counseling.

Advertisement Currently that you've decided personal bankruptcy is undoubtedly the ideal course of activity and you with any luck cleared it with an attorney you'll require to get begun on the documents. Before you dive into all the main insolvency forms, you ought to obtain your own records in order.

8 Easy Facts About Bankruptcy Lawyer Tulsa Explained

Later down the line, you'll really require to prove that by divulging all type of info concerning your financial events. Right here's a basic list of what you'll need when driving ahead: Determining documents like your motorist's certificate and Social Security card Income tax return (up to the previous 4 years) Evidence of income (pay stubs, W-2s, independent earnings, revenue from assets in addition to any earnings from government benefits) Bank statements and/or retired life account statements Proof of value of your assets, such as vehicle and property assessment.

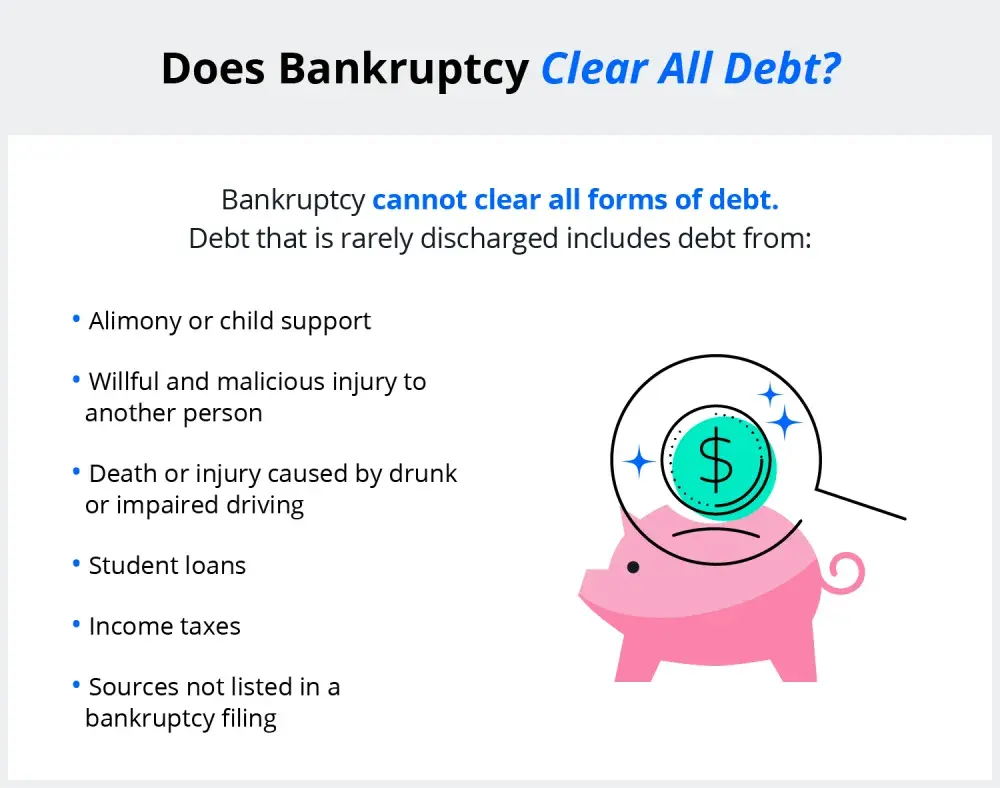

You'll desire to comprehend what type of debt you're trying to settle.

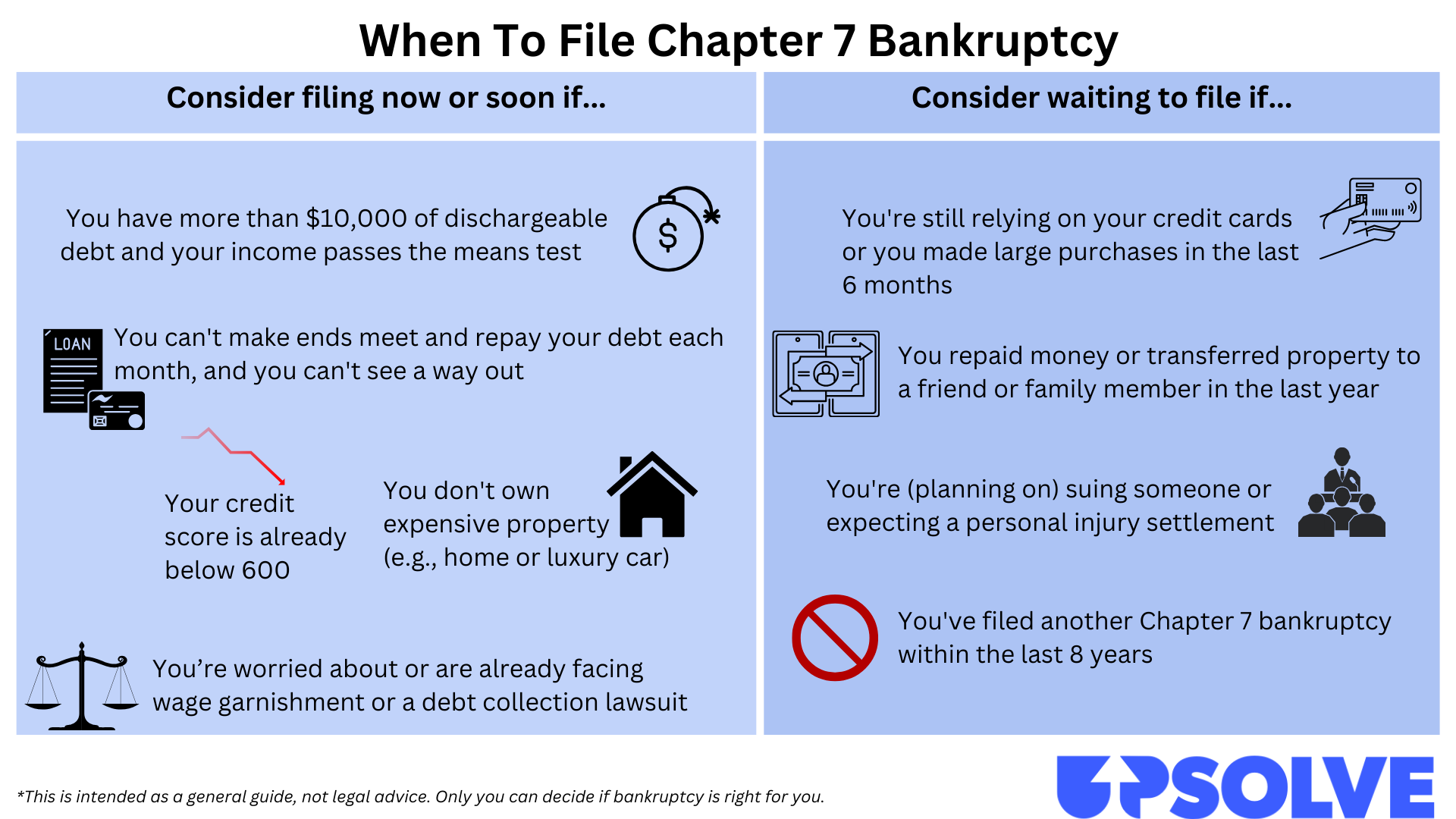

You'll desire to comprehend what type of debt you're trying to settle.If your income is too expensive, you have another alternative: Phase 13. This alternative takes longer to solve your financial debts because it requires a long-lasting settlement strategy usually three to five years before a few of your continuing to be debts are wiped away. The declaring procedure is likewise a great deal more intricate than Chapter 7.

The Best Guide To Tulsa Ok Bankruptcy Specialist

A Phase Tulsa bankruptcy lawyer 7 bankruptcy remains on your credit score report for ten years, whereas a Phase 13 bankruptcy diminishes after 7. Both have long lasting effect on your credit rating, and any kind of brand-new financial obligation you obtain will likely come with greater passion prices. Before you submit your personal bankruptcy kinds, you need to initially complete a required course from a credit therapy agency that has actually been approved by the Department of Justice (with the notable exception of filers in Alabama or North Carolina).

The training course can be completed online, in individual or over the phone. You must complete the training course within 180 days of declaring for personal bankruptcy.

Which Type Of Bankruptcy Should You File for Dummies

An attorney will usually manage this for you. If you're filing on your very own, recognize that there are concerning 90 various insolvency districts. Examine that you're submitting with the appropriate one based on where you live. If your long-term house has relocated within 180 days of filling, you should file in the district where you lived the higher part of that 180-day period.

Generally, your personal bankruptcy attorney will collaborate with the trustee, yet you might require to send out the person records such as pay stubs, income tax return, and savings account and bank card statements straight. The trustee who was simply assigned to your situation will certainly soon establish an obligatory conference with you, called the "341 meeting" because it's a need of Section 341 of the U.S

You will certainly require to offer a prompt list of what certifies as an exception. Exceptions may relate to non-luxury, key vehicles; essential home items; and home equity (though these exceptions rules can vary commonly by state). Any kind of home outside the you can check here checklist of exemptions is considered nonexempt, and if you do not supply any type of checklist, then all your residential or commercial property is taken into consideration nonexempt, i.e.

You will certainly require to offer a prompt list of what certifies as an exception. Exceptions may relate to non-luxury, key vehicles; essential home items; and home equity (though these exceptions rules can vary commonly by state). Any kind of home outside the you can check here checklist of exemptions is considered nonexempt, and if you do not supply any type of checklist, then all your residential or commercial property is taken into consideration nonexempt, i.e.The trustee would not offer your cars to instantly settle the creditor. Rather, you would pay your financial institutions that amount over the course of your repayment strategy. A common misconception with bankruptcy is that when you file, you can quit paying your debts. While personal bankruptcy can help you wipe out numerous of your unprotected debts, such as past due medical costs or personal loans, you'll intend to maintain paying your regular monthly payments for safe financial debts if you wish to maintain the residential property.

Tulsa Debt Relief Attorney Fundamentals Explained

If you go to threat of repossession and have worn down all other financial-relief choices, then applying for Phase 13 may delay the foreclosure and assistance conserve your home. Eventually, you will certainly still require the earnings to proceed making future home loan payments, along with paying off any late settlements over the program of your payment strategy.

If so, you might be called for to give additional details. The audit could delay any type of financial debt relief by a number of weeks. Obviously, if the audit transforms up incorrect information, your situation might be rejected. All that said, these are rather unusual circumstances. That you made it this much while doing so is a respectable indication at the very least a few of your financial debts are qualified for discharge.

Report this page